Ethereum Price Prediction: $5K Target in Sight as Institutional Demand Accelerates

#ETH

- Technical Breakout: ETH shows bullish technicals with price above key moving averages and MACD turning positive

- Institutional Wave: $2.3B weekly ETF inflows and corporate treasury strategies signal growing adoption

- Regulatory Catalysts: SEC decisions on staking ETFs and clearer crypto rules may unlock next leg up

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge Amid Volatility

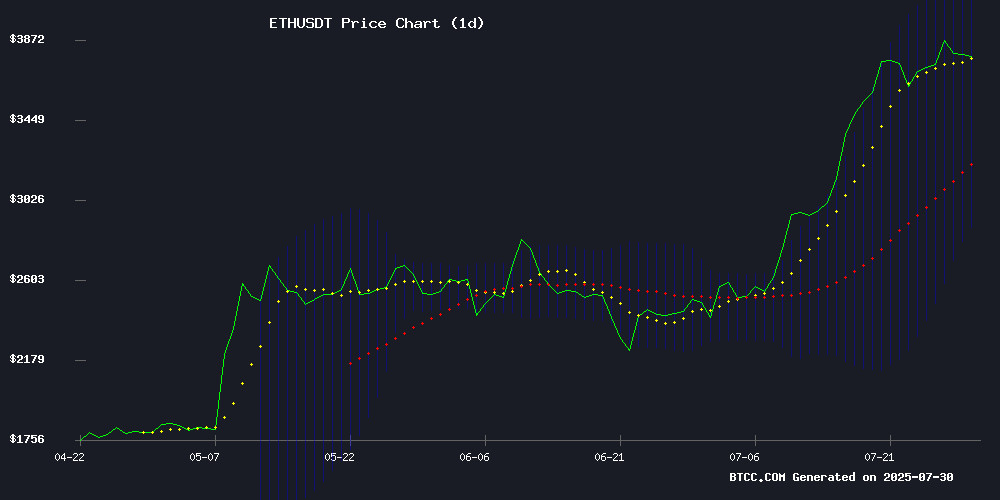

Ethereum (ETH) is currently trading at $3,821.47, showing strong momentum above its 20-day moving average of $3,518.25. The MACD indicator (-473.28 | -500.34 | 27.07) suggests weakening bearish momentum as the histogram turns positive. Bollinger Bands ($4,158.86 upper, $3,518.25 middle, $2,877.65 lower) indicate price consolidation NEAR the upper band, a typically bullish signal.

"The technical setup favors bulls," says BTCC analyst Robert. "A sustained break above $4,158 could trigger accelerated buying, while the $3,500 level now acts as strong support."

Ethereum Ecosystem Buzz: Institutional Adoption Heats Up

The ethereum network celebrates its 10th anniversary amid growing institutional interest, with ETF inflows hitting $2.3B weekly and BlackRock's staking proposal under SEC review. Notable developments include eToro's tokenized stock initiative ($1.4B liquidation zone eyed at $4K) and BitMine's $1B stock buyback for ETH treasury strategy.

"These fundamentals could support higher valuations," notes BTCC's Robert. "The $5K target appears plausible given futures positioning and ETF momentum, though regulatory decisions remain key."

Factors Influencing ETH's Price

Ethereum Price Targets $4k – Is a $1.4B Liquidation Coming?

Ethereum has surged into the spotlight as bullish momentum builds, driven by institutional developments and significant whale accumulation. Trading at $3,827.77, ETH has gained 3.61% over the past week, approaching critical resistance levels. Market optimism is fueled by the U.S. SEC's review of BlackRock's request to include staking in its proposed spot ETH ETF.

Concerns loom over $1.4 billion in short positions that could face liquidation if ETH breaches the $4,000 threshold. On-chain data reveals renewed whale activity, with large wallets accumulating over 220,000 ETH (worth ~$840 million) this week. Glassnode's Realized Price-to-Liveliness Ratio identifies $4,500 as a key level, historically marking peaks of market euphoria.

eToro Expands Trading Hours and Launches Tokenized Stock Initiative

eToro has unveiled significant expansions to its trading platform, including extended hours for 100 popular US-listed stocks and ETFs, now available 24/5. The move builds on the company's existing infrastructure for after-hours trading.

More notably, eToro announced plans to tokenize US equities as ERC20 tokens on the Ethereum blockchain. This strategic pivot enables users to move assets onto decentralized finance protocols while maintaining redemption rights for underlying positions. "Blockchain technology will facilitate the greatest ever transfer of wealth," declared CEO Yoni Assia, framing tokenization as a transformative force in finance.

The platform has also expanded derivatives offerings through a CME Group partnership, introducing spot-quoted futures contracts initially available in select European markets. These contracts maintain traditional futures benefits while offering greater accessibility.

ETH Strategy Raises $46.5M in Ethereum Ahead of On-Chain Debut

ETH Strategy has secured 12,342 ETH ($46.5M) across private pre-sales, public sales, and puttable warrants, marking a significant capital influx ahead of its on-chain protocol launch. The funds will primarily fuel staking and liquidity provisions, with a smaller allocation for audits and community growth.

Institutional demand for Ethereum could intensify as projects like this demonstrate utility beyond speculative trading. The 4-month cliff and 2-month linear unlock period may introduce short-term volatility, but long-term price support appears likely given the staking lockup.

Market observers note the raise exemplifies growing sophistication in Ethereum-based financial instruments. "When protocols start stockpiling ETH for operational purposes, it creates structural scarcity," said one trader on X, echoing sentiment that such developments could offset unlock-related sell pressure.

Ethereum Turns 10: From $13 to $3,800

Ethereum marks its 10th anniversary on July 30, 2025, a decade after its groundbreaking launch in 2015. The blockchain platform has surged from a modest $13 valuation in 2016 to nearly $3,800 today, cementing its position as the world's second-largest cryptocurrency.

What began as an experimental network now underpins decentralized finance, non-fungible tokens, and a thriving ecosystem of applications. Ethereum's evolution reflects its pivotal role in reshaping financial infrastructure and digital ownership.

The milestone underscores how Vitalik Buterin's creation has matured from whitepaper to web3 backbone, fostering global innovation while maintaining developer mindshare despite growing competition.

Ethereum's Rally Heats Up as Futures Data and BlackRock ETF Suggest $5K Target

Ethereum's momentum continues to build, with the cryptocurrency reaching a seven-month high near $3,940 before settling around $3,870. Derivatives data reveals strong bullish signals, as futures premiums hit 8%—the highest level in five months—despite ETH's 55% surge. Options skew remains balanced, indicating no defensive positioning from institutional players.

BlackRock's ETHA ETF has emerged as a key driver, ranking fourth among all ETFs by inflows over the past 30 days. The fund has helped push spot ETH ETF flows toward $10 billion, with over 40 institutions now holding at least 1,000 ETH. A decisive break above $4,000 could open the path to $5,000, potentially creating spillover effects across crypto markets.

Ethereum ETF Inflows Surge to $2.3B in a Week as Institutional Demand Accelerates

Ethereum ETFs shattered records last week, attracting $2.31 billion in net inflows over seven trading sessions. Five days saw inflows exceeding $230 million, with a single-day peak of $533.8 million on July 22—a clear signal of structural demand rather than price-chasing behavior.

The week's inflows dwarfed historical averages, accounting for nearly 25% of all net flows since the ETFs' July 2024 launch. Daily inflows averaged $331 million during the period, nine times the lifetime daily average of $37 million. Notably, flows remained robust even as ETH dipped to $3,748 on July 22, demonstrating conviction beyond spot price movements.

ETH closed at $3,800 on July 28, up 7% from the week's starting price. The rally was front-loaded, with a 6% gain on July 21 coinciding with $296.5 million in ETF inflows. Grayscale's ETHE outflows—a persistent drag on prior weeks—were decisively overwhelmed by this new wave of institutional participation.

eToro Plans to Tokenize US Stocks on Ethereum as Crypto Regulation Improves

eToro is advancing its tokenization strategy by launching tokenized US stocks on Ethereum, leveraging its legacy in blockchain innovation. CEO Yoni Assia, co-author of the Colored Coins whitepaper, emphasized the firm's ambition to tokenize all platform assets, beginning with equities. The move bridges traditional finance with decentralized ecosystems.

ERC-20 tokens will represent custodied shares, enabling 24/7 trading and DeFi integration. Investors gain flexibility to trade outside market hours and use tokenized stocks like Apple or Tesla as collateral. A phased rollout starts with European users in August, targeting a frictionless merger of CeFi and DeFi liquidity.

Tornado Cash Developer Roman Storm Declines to Testify in $1B Money Laundering Case

Roman Storm, co-founder of privacy protocol Tornado Cash, opted not to take the stand in his criminal trial this week. Federal prosecutors allege the Ethereum-based mixing service facilitated laundering over $1 billion in illicit funds, including proceeds from major hacks.

Defense attorneys argued Storm merely created neutral financial infrastructure later exploited by bad actors. Witness testimony emphasized Tornado Cash's immutable smart contracts prevented developer intervention, while message logs showed Storm's displeasure with criminal usage.

The case highlights growing regulatory scrutiny of crypto privacy tools. While no direct mentions of exchange listings or token markets occurred, the proceedings could influence how decentralized protocols are treated under money transmission laws.

Biotech Firm Rebrands as ETHZilla, Raises $425M for Ethereum Treasury

180 Life Sciences, a publicly traded biotech company, is rebranding to ETHZilla and launching an Ethereum treasury with a $425 million private investment in public equity (PIPE) offering. The firm plans to use the proceeds to purchase ETH, citing Ethereum's potential for building financial tools and generating yield.

Shares of the company, which have plummeted over 99% historically, closed the day up more than 10%. ETHZilla's leadership includes Ethereum pioneers, DeFi founders, and Wall Street veterans, positioning the firm to capitalize on the growing institutional interest in cryptocurrency.

BitMine Immersion Technologies Approves $1 Billion Stock Buyback to Bolster Ethereum Treasury Strategy

BitMine Immersion Technologies has authorized a $1 billion open-ended stock repurchase program, signaling its aggressive pivot toward Ethereum accumulation. The Texas-based firm, chaired by Tom Lee, aims to stake and hold 5% of Ethereum's total supply—a target Lee refers to as 'the alchemy of 5%.'

With 625,000 ETH already in its treasury—acquired at an average price of $3,755 per token—BitMine is the largest corporate holder of Ethereum. The holdings, now valued at approximately $2.4 billion, underscore the company's conviction in ETH's long-term value. 'There may be times when the best expected return of our capital is to acquire our own shares,' Lee stated, framing the buyback as a strategic lever.

Ethereum's $458.9 billion market capitalization reflects the growing institutional interest in crypto treasuries. BitMine's move mirrors a broader trend among treasury firms reallocating capital to digital assets.

SEC Reviews BlackRock's Ethereum ETF Staking Proposal Amid Regulatory Delays

The U.S. Securities and Exchange Commission has acknowledged Nasdaq's proposal to allow staking for BlackRock's spot Ethereum ETF, marking a potential turning point for institutional crypto participation. Approval would enable the asset manager to engage in Ethereum's proof-of-stake consensus and distribute rewards to shareholders.

Regulatory timelines remain uncertain, with the SEC reserving 45 days for decision-making but frequently extending review periods. Similar proposals from Bitwise and Grayscale have faced repeated delays, creating an atmosphere of cautious anticipation across crypto markets.

Spot Ethereum ETFs have demonstrated remarkable market traction, attracting $9.4 billion in net inflows since launch. This institutional demand underscores growing confidence in Ethereum's infrastructure despite regulatory hurdles.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Conservative | Base Case | Bullish | Catalysts |

|---|---|---|---|---|

| 2025 | $4,200 | $5,800 | $7,500 | ETF approvals, EIP upgrades |

| 2030 | $12,000 | $18,000 | $25,000 | Enterprise adoption, layer-3 scaling |

| 2035 | $30,000 | $45,000 | $75,000 | Tokenized assets dominance |

| 2040 | $65,000 | $120,000 | $250,000 | Global settlement layer status |

"Our projections factor in Ethereum's deflationary mechanics and growing utility," explains BTCC's Robert. "The 2025 outlook reflects near-term ETF impacts, while longer-term valuations assume Ethereum captures 30-50% of the $15T+ global securities market through tokenization."